tax forgiveness pa chart

Tom Wolfs 2021-22 budget proposal includes the largest personal income tax rate increase in state history while also providing some tax forgiveness or relief to lower. For more information visit the Internal Revenue Services at www.

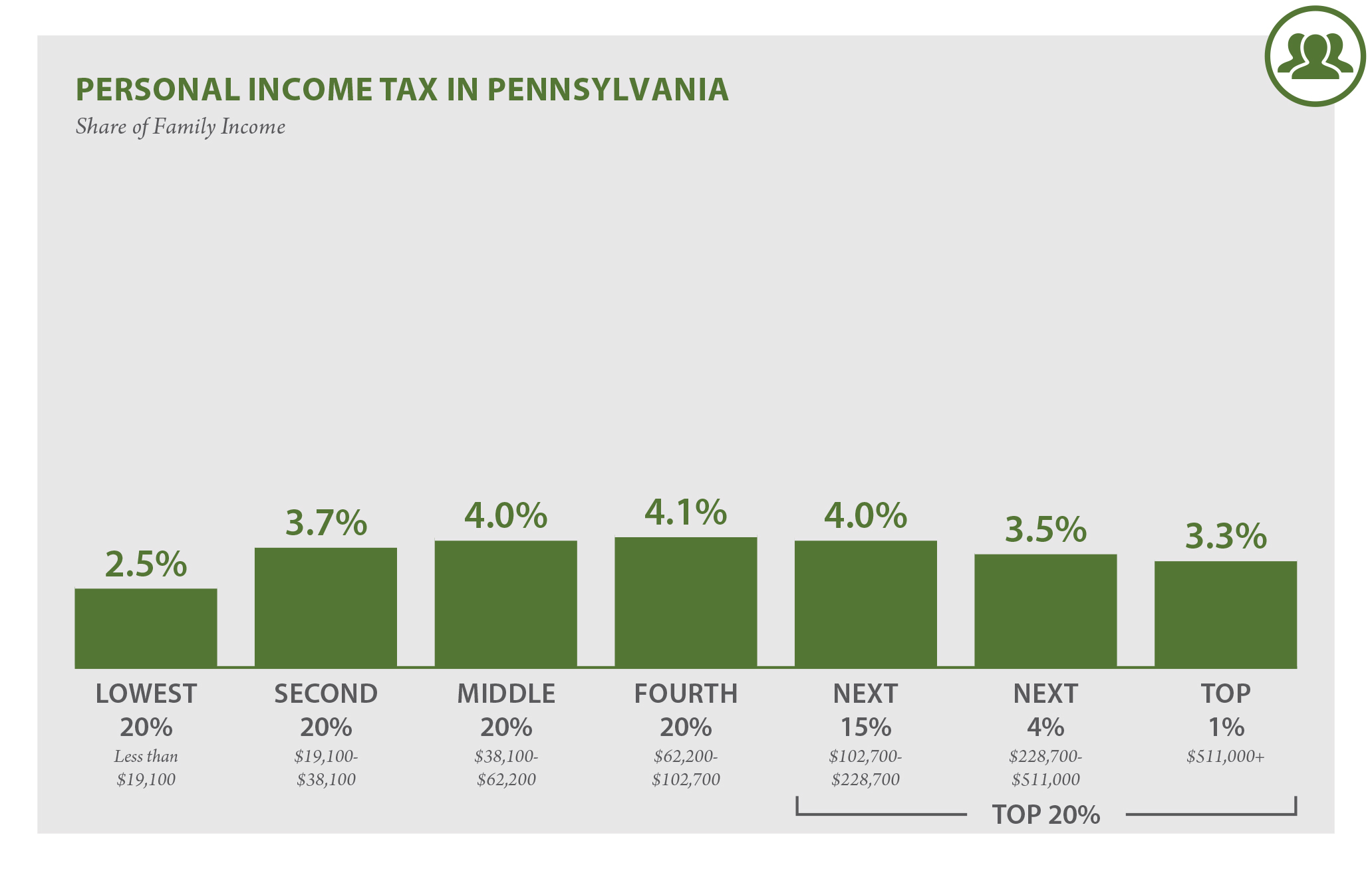

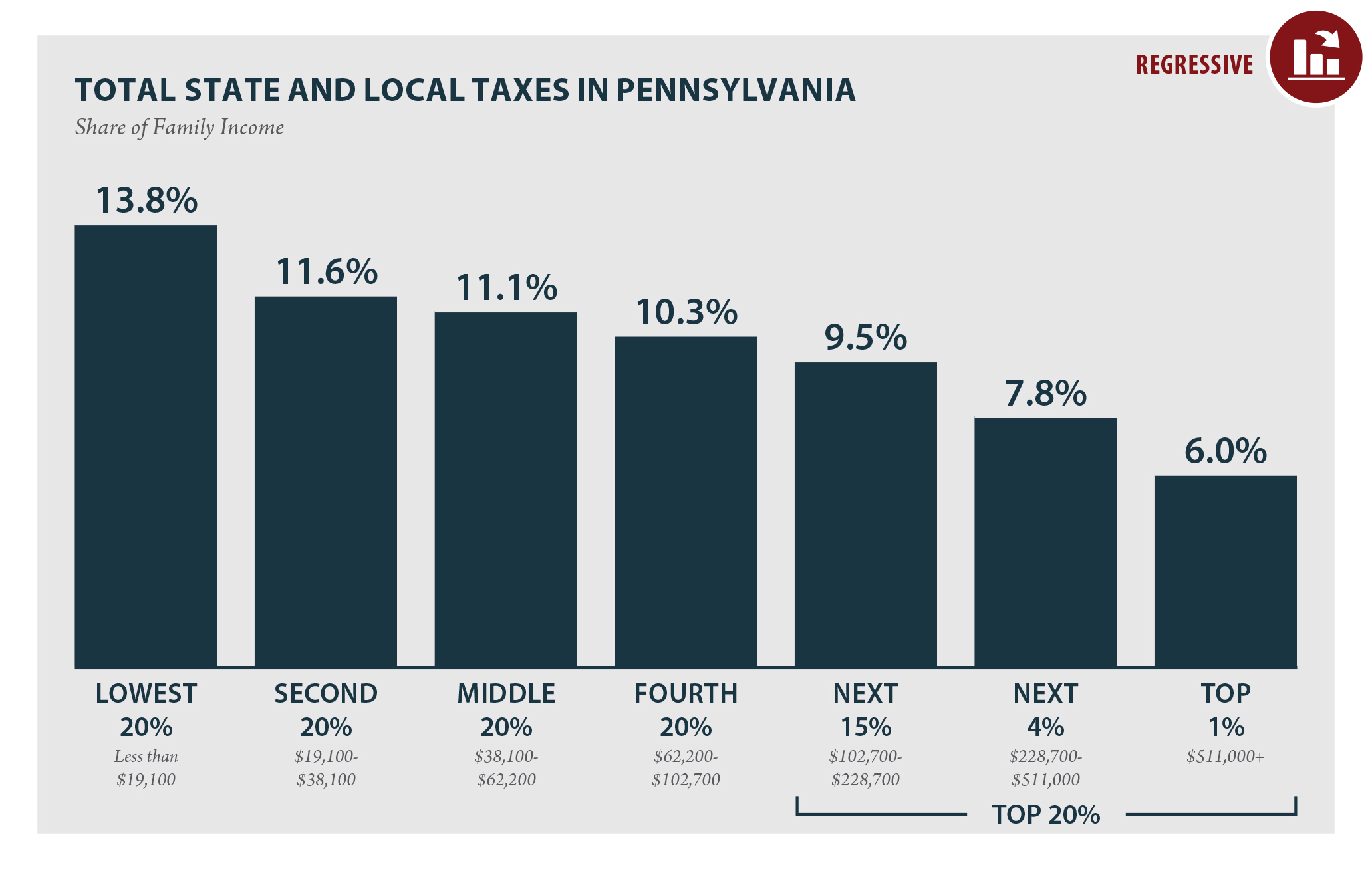

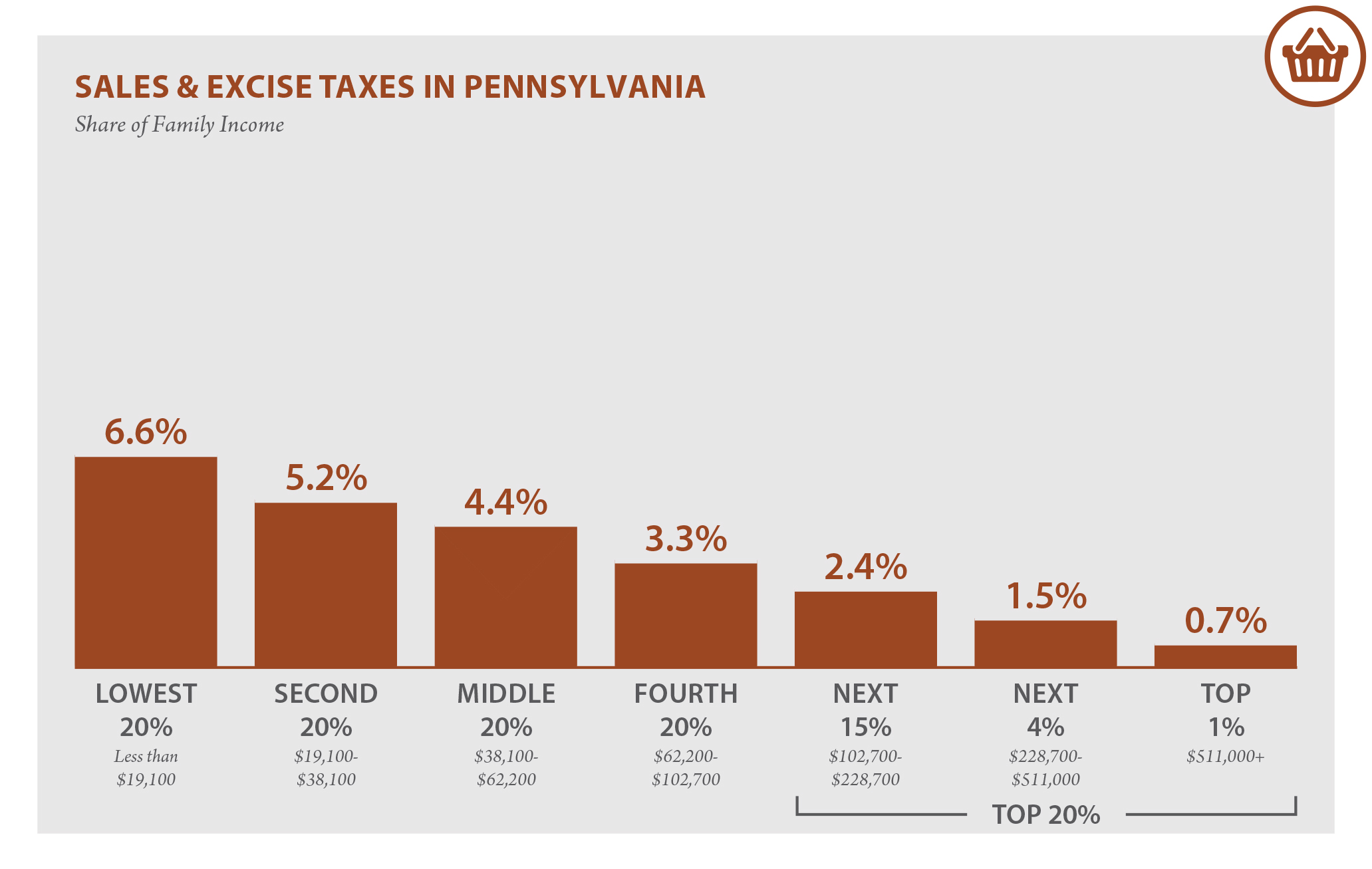

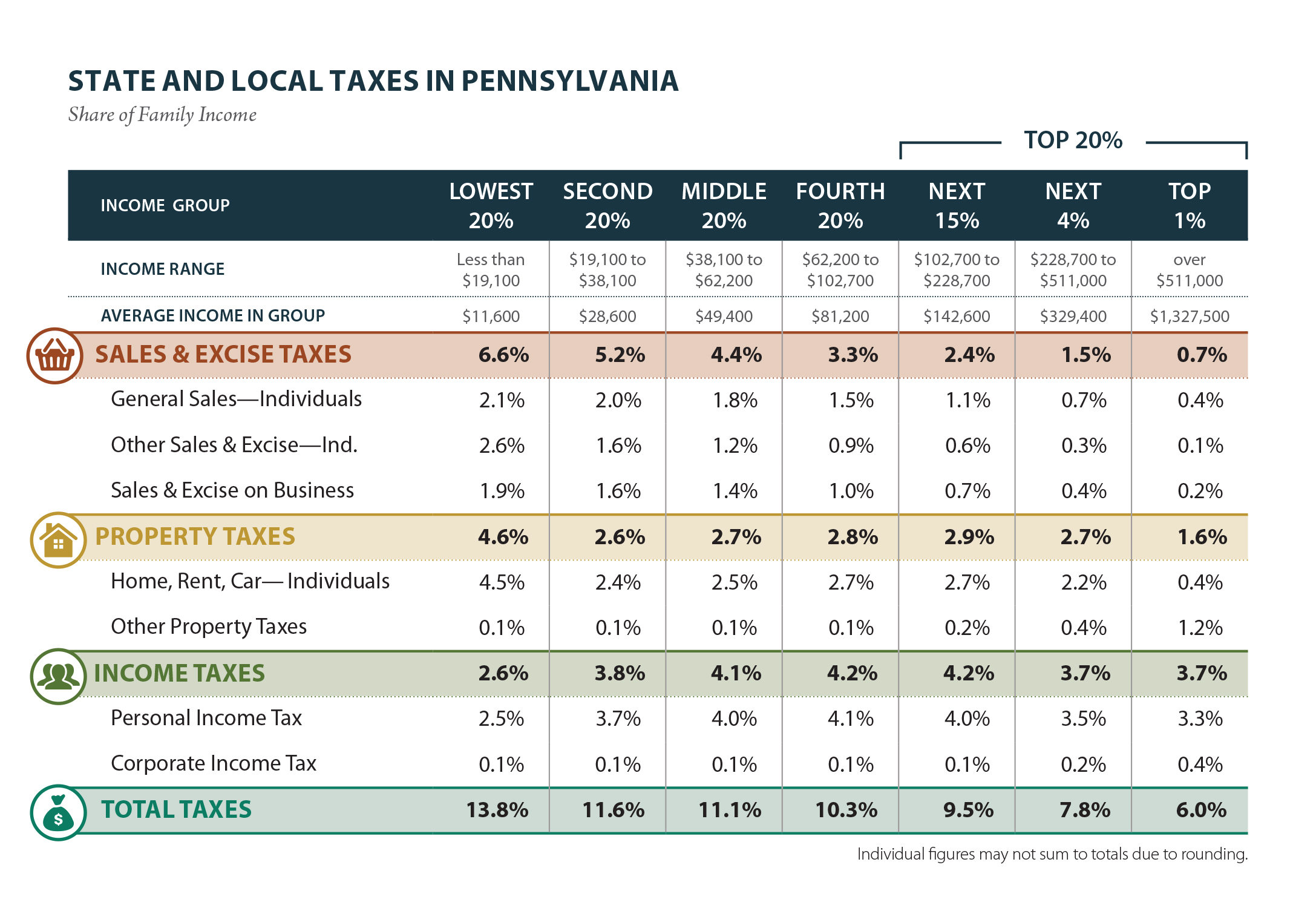

Pennsylvania Who Pays 6th Edition Itep

2 months ago 3173 KB Download.

. If you live in PA and open a non-PA ABLE account you may miss out on important benefits. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program. Tax Forgiveness Pa Chart.

It ranges from 0 to 100 in 10 increments. Compare the Top Tax Relief Services and Find the One Thats Best for You. Provides a reduction in tax liability and.

Ad This is the newest place to search delivering top results from across the web. Their joint PA tax return should show they owe 368. Philadelphia residents who qualify for PAs Tax Forgiveness program can get a partial refund of city wage tax withheld by their employer.

Explore The Steps You Need To Take And Relief Options Available To You. With completing the remaining parts. The more dependent children you have and the less income you make the higher the percentage of tax forgiveness you will.

For example in Pennsylvania a single person who makes. Answer on Line 1 and Line 2 proceed. Rate answer 1 of 3 Rate answer 2 of.

Ad See the Top 10 Tax Relief Services. Separated pursuant to a written separation. Get Instant Recommendations Trusted Reviews.

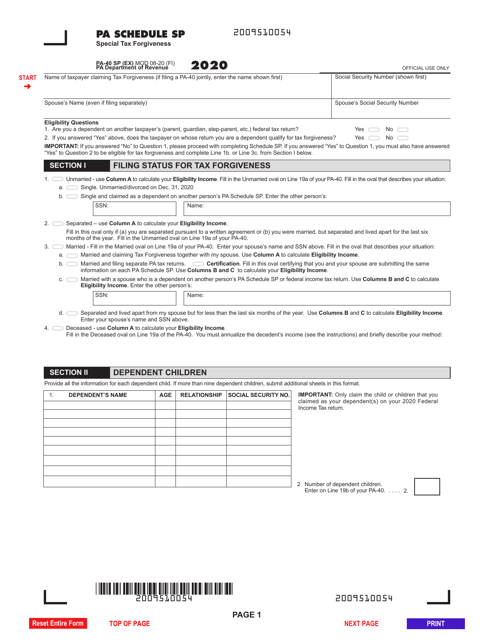

Form PA-40 SP requires. Click the Tax Forgiveness Chart link to see teh PA Schedule SP Eligibility Income Tables. Small Business Administrations Paycheck Protection Program PPP is providing an important lifeline to help keep millions of small businesses open and their workers.

Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide. PPP State Tax Treatment Chart. Or call the IRS toll-free 1-800-829-1040.

The departments instructions allow dependent children to claim tax forgiveness because as the 1974 law identifies the intent of the General Assembly as described above. On the other hand if you dont file your. However they qualify for 100 percent Tax Forgiveness if they file a PA tax return and PA Schedule SP.

Tax forgiveness pa chart Saturday February 19 2022 Edit. Ad Tax Debt Relief - What Are Your Options - Payment Plans and How Do They Work. If you live in PA and open a non-PA ABLE account you may miss out on important benefits.

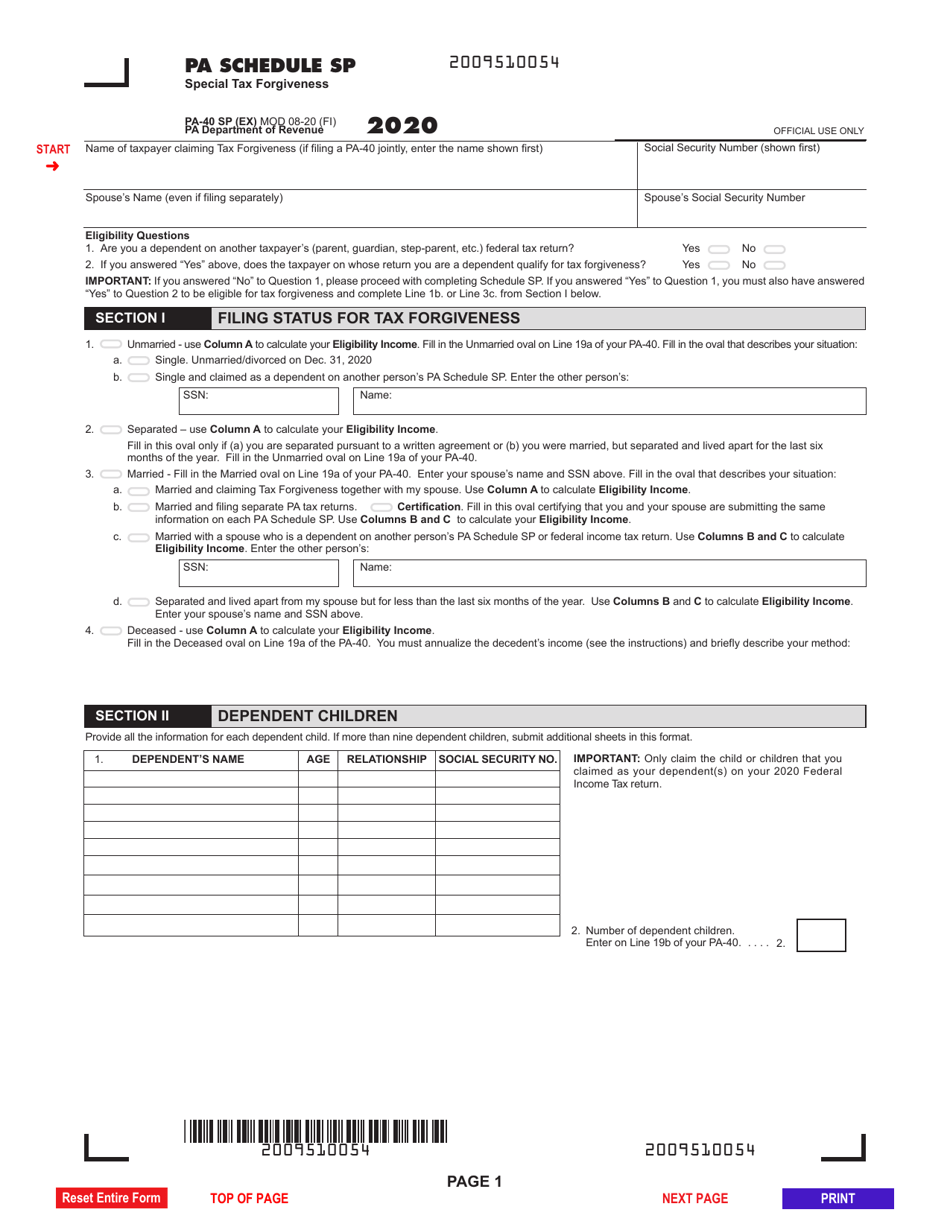

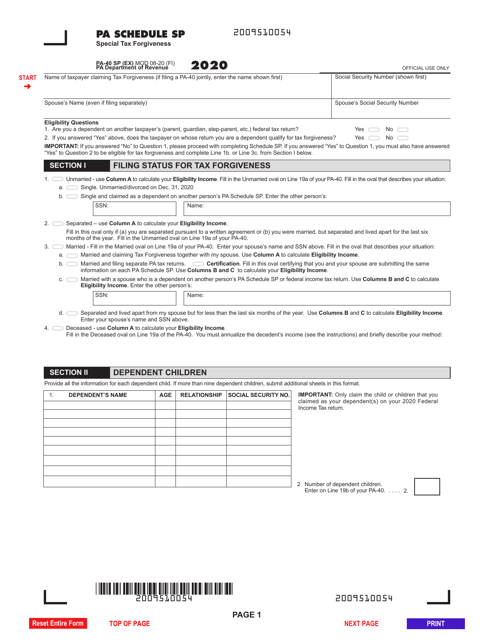

UNMARRIED means single widowed or divorced on December 31. Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide. Instructions for PA-40 Schedule SP Special Tax Forgiveness PURPOSE OF SCHEDULE Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to.

21st Century Cures Act Medicare Advantage Risk Adjustment Payment Model. If Yes is the. These standards vary from state to state.

It is worth noting that during their 2021 legislative sessions multiple states have enacted legislation conforming to the current federal tax treatment of forgiven ppp. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability.

Of PA-40 Schedule SP to determine. States also offer tax forgiveness based on personal income standards. A reference chart on the state tax treatment of Paycheck Protection Program PPP loan forgiveness as taxable income as well as whether a state allows expenses paid.

Was this answer helpful. Fill in the oval that describes your status as of December 31. Content updated daily for pa state tax forgiveness.

CALCULATION OF TAX FORGIVENESS DEFINITION OF ELIGIBILITY INCOME Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal income tax. Eligibility for Tax Forgiveness. The Paycheck Protection Program PPP created as part of the.

Pennsylvania Who Pays 6th Edition Itep

Pennsylvania Who Pays 6th Edition Itep

Commonwealth Of Pennsylvania V Navient Corporation Et Al Commonwealth Corporate Student Loans

Pennsylvania Sales Tax Small Business Guide Truic

Advocates Gearing Up For Fair Education Funding Push The Mercury

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

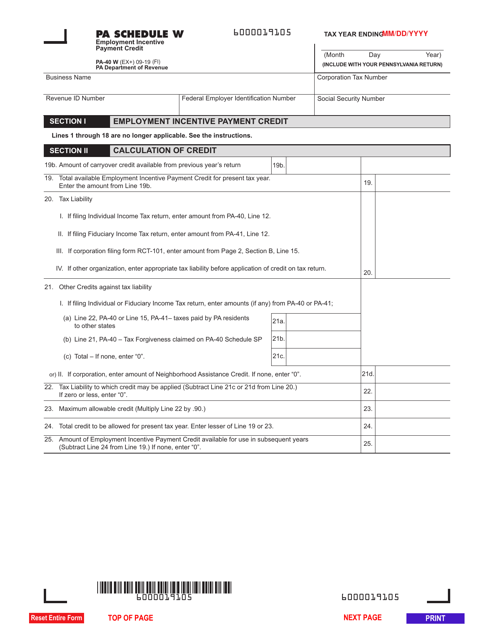

Form Pa 40 Schedule W Download Fillable Pdf Or Fill Online Employment Incentive Payment Credit Pennsylvania Templateroller

Charting The Profession S Priorities 2021 2022 Legislative Survey Insights Aia Pennsylvania

Pa Cares Providing Relief For Working People In A Time Of Crisis

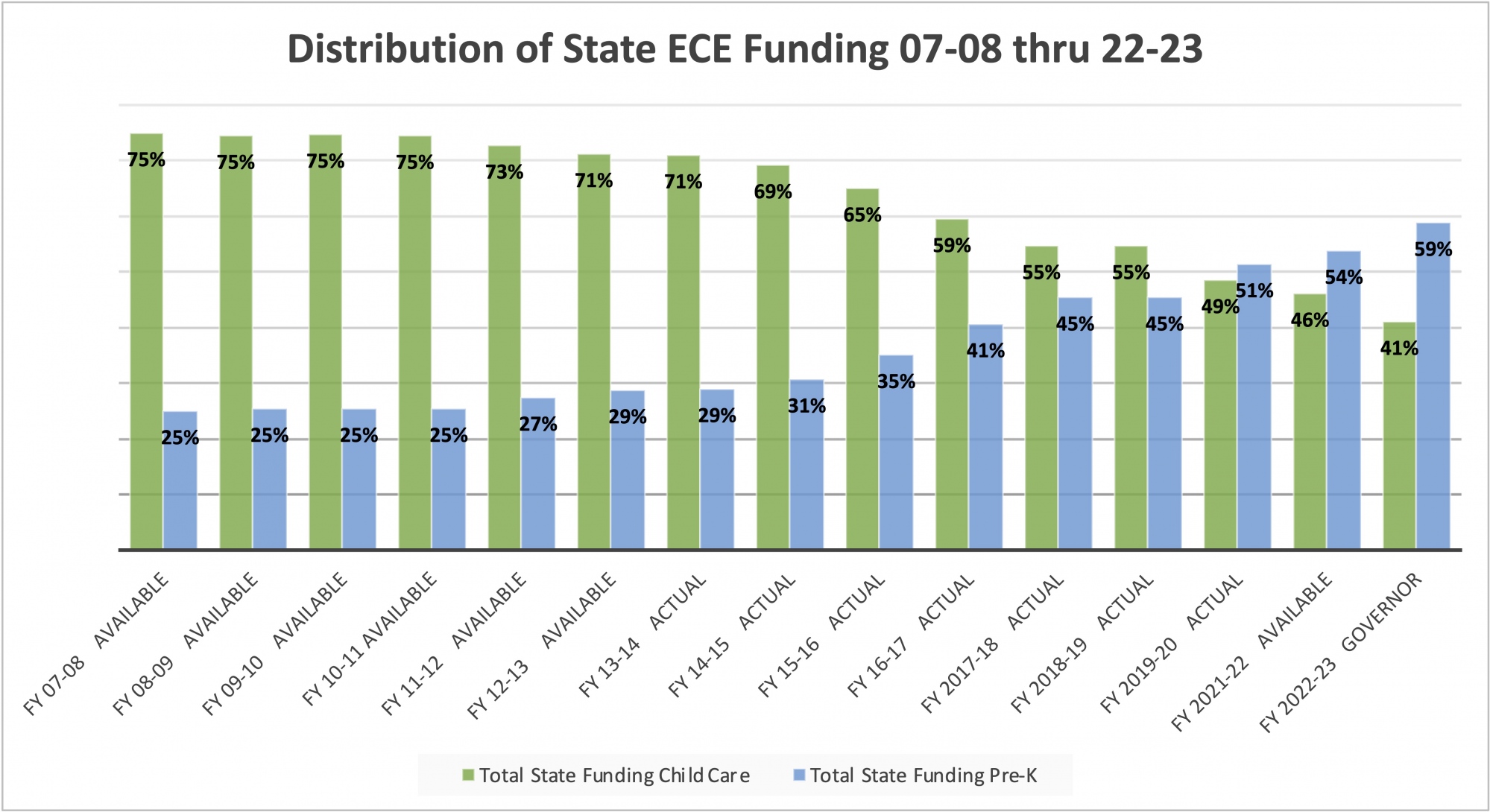

State Policy Budget Issues Pennsylvania Child Care Association

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Advocates Gearing Up For Fair Education Funding Push The Mercury

Pennsylvania Who Pays 6th Edition Itep

Pa Cares Providing Relief For Working People In A Time Of Crisis